According to the European Parliament on 18 December, the European Parliament and EU governments reached an agreement on the EU Emissions Trading System (EU ETS) reform proposal. The content of the agreement specified that the Carbon Border Adjustment Mechanism (CBAM “Carbon Tariff”) will be formally levied from 2026.

What is a Carbon Tariff?

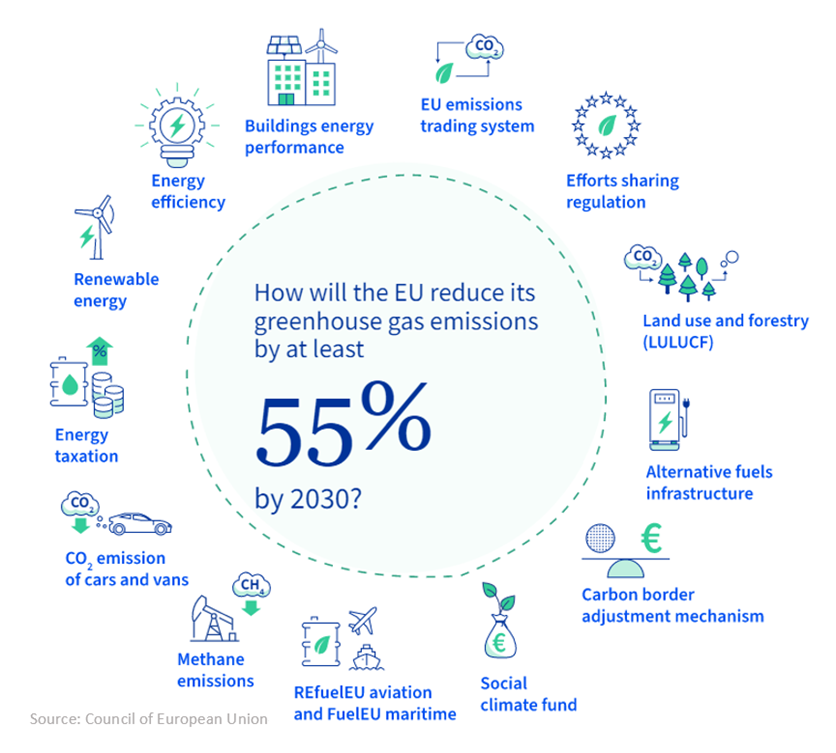

“Fit for 55” is a green transition program, which is part of the EU’s implementation of greenhouse gas emission reductions. The program plans to address climate change by strengthening the polluter-pays principle, thereby reducing greenhouse gas emissions in 2030, and protecting jobs and citizens. Ultimately, achieving net zero emissions and carbon neutrality by 2050.

The plan includes 12 proposals including expanding the EU carbon market, stopping the sale of fuel vehicles, imposing aviation fuel tax, raising the proportion of renewable energy, and establishing a carbon tariff. The first goal is to reduce carbon emissions by 55% by 2030 compared to 1990 levels.

Dating back to the European Parliament on 22 June 2022, the European Commission, the Council of the EU and the European Parliament have all formed their own CBAM plans. The three parties have discussed and negotiated thrice on 11 July, 4 October and 8 November. After the reform, the scheme “sends a clear signal to European industry that investing in green technologies pays off”, said Peter Liese, the main rapporteur of the European Parliament, the reformed EU carbon market now “covers almost all sectors of the economy”, following the decision to extend the scheme to offshore emissions and waste incineration.

What is an Emissions Trading System?

By 2027, the European Parliament has said to establish a separate new emissions trading system (ETS II), which will be used for road transport and construction fuels. The package will also cover fuels for manufacturing and other industries, as requested by parliament. ETS II could be delayed until 2028 if energy prices are abnormally high. In addition, a new price stabilization mechanism will be established to ensure that if the subsidy price in ETS II exceeds 45 EUR, an additional 20 million subsidy will be issued.

National sectors can urge enterprises and the industrial chain to reduce carbon from the product end, with emission calculation method (or carbon footprint measurement) based on the life cycle of the product, from design, production, sales and use. Determining carbon emissions in each and every section could guide enterprises to manage carbon emissions of the whole production chain, to produce low-carbon products. Furthermore, indirect carbon emissions can be brought down, facilitating the total carbon reduction of all sections of the supply chain.

In response to the EU’s CBAM, countries should take advantage of the golden opportunity right now, before Carbon Tariff has been formally implemented. Establish a product life cycle carbon emission calculation system ASAP, to prepare for the upcoming carbon tariff and enhance the international competitiveness of products.