China’s national carbon market started trading on July 16 last year. In order to summarize and review the first anniversary of China’s carbon market, Treelion has prepared a series of articles to interpret the carbon market in depth.

Looking back on 2021, the eight pilot carbon markets are running smoothly in parallel with the national carbon market. Although the total transaction volume of the pilot allowances has decreased compared with 2020, the carbon price has risen. After the launch of the national market, the coverage of the pilot is reduced, and transaction volume may be affected.

Taking Guangdong as an example, the free quotas have been tightened in the past 4 to 5 years. This year, the cement, steel, petrochemical and paper industries have been reduced by 1% compared with last year. At the same time, the proportion of paid allocations for new projects has been expanded from 3% to 6%.

It is expected that as more industries are incorporated into the national market, maturely incorporated industries are expected to be gradually removed from the pilot, but if the incorporation of industries into the national market is slower than expected, the pilot may continue beyond 2025.

The pilot also has an existing role and is irreplaceable. The uniqueness of the pilot lies in the association with local enterprises, the regional characteristics of the industry, and the familiarity and training of local exchanges with enterprises.

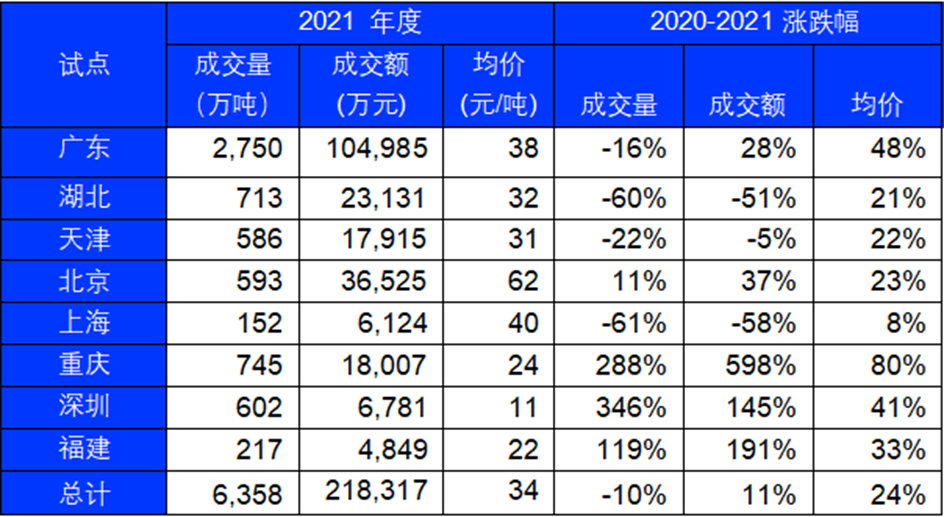

Status of Pilot Transactions in 2021

Looking back on 2021, the eight pilot carbon markets are running smoothly in parallel with the national carbon market. Although the total transaction volume of the pilot allowances has decreased compared with 2020, the carbon price has risen. In terms of transactions, the total transaction volume of pilot quotas is about 64 million tons (about 36% of the national carbon market), the transaction volume is about 2.183 billion, and the total average price is 34 yuan/ton, about 4.5 euros/ton.

Compared with the transaction situation in 2020, Beijing, Guangdong (excluding Shenzhen) and Tianjin have received regional pilot allocation quotas and implemented the contract in the regional pilot. Superimposed on the epidemic prevention and control in 2020, the demand for energy consumption has decreased, and the overall transaction demand of the regional pilot has been fulfilled. The scale has declined, and the total transaction volume has dropped by 10%.

The annual average price of the eight pilots exceeded the national carbon market average price except for the Beijing pilot with a high price of 62 yuan/ton (the average BEA price of the Beijing pilot in the first half of 2022 was 59 yuan/ton). increased, but far below the national level.

The industries included in the pilots are different, and the price of quotas varies greatly. Among them, the lowest pilot price in Shenzhen is about 11 yuan/ton, and the prices in Fujian and Chongqing are both lower than 25 yuan/ton.

The price of the pilot project is still the highest in the whole year before the performance period is approaching. Taking the pilot project in Beijing as an example, in mid-September, the price of BEA was as high as 107 yuan / ton, breaking the previous record.

2021 CCER for national and pilot compliance

Due to the compliance of the carbon market, the transaction volume has risen sharply since November, with a total transaction volume of nearly 170 million tons, a month-on-month increase of 170% compared with 2020.

Among them, 34 million tons of CCERs are used in the first compliance cycle of the national carbon market, and more than 2 million tons of other types of cancellations have accumulated so far, with a market surplus of nearly 13 million tons.

Development and Unique Design of Pilot Carbon Market Mechanism

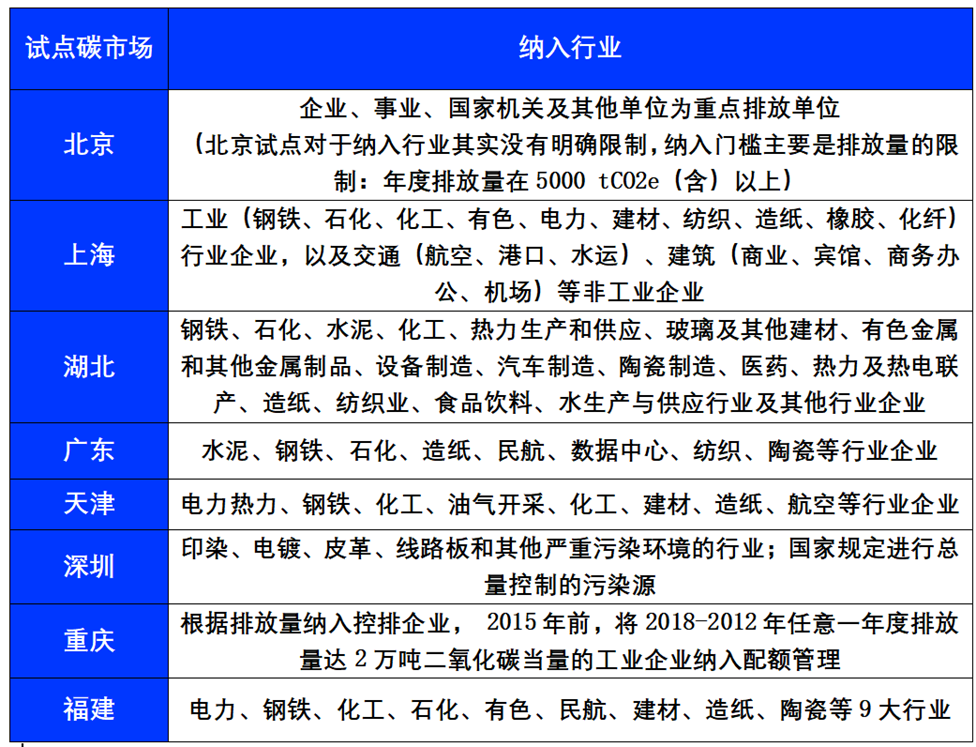

The differences in market design between the pilot carbon market and the national carbon market mainly include the inclusion of industries, auctions, and allowing individual transactions.

The national carbon market currently includes only one industry in the power industry, and the pilot has included the carbon market industry according to the key high-emission industries in its own region, which has local characteristics.

In addition to electricity, industrial enterprises such as data centers, papermaking, textiles, rubber and chemical fibers, ceramics, glass, etc., non-industrial enterprises such as aviation, ports, airports, commerce, hotels, finance, etc., as well as printing and dyeing, electroplating, leather, circuit boards and others The industries that seriously pollute the environment; the pollution sources stipulated by the state for total control are included in the pilot carbon market and included in the industry (scope).

Various cancellations have accumulated to more than 2 million tons so far, and the market balance is nearly 13 million tons.

After years of operation and the update of the top-level design system, the pilot carbon market has been relatively mature and has included more industry entities, and it is more closely connected with the local economy. The total number of emission-controlled enterprises included far exceeds the 2000+ enterprises in the national power industry. relatively large force. At the same time, due to the influence of competing companies in the same industry, some non-emission-controlled enterprises in the pilot areas will also choose to purchase relevant emission reductions in the local pilot exchanges to conduct voluntary carbon neutralization of enterprises, so as to enhance the social responsibility and influence of enterprises. In the later stage, the national carbon market is expected to include more industries, including cement, electrolytic aluminum, petrochemical, aviation and other industries, and will involve more enterprises and individuals.

Different from the national carbon market, the pilot carbon market includes an important quota auction method for the regulation of market carbon prices and the guarantee mechanism of market operation.

Among them, pilots in Shanghai and Tianjin use higher-than-market punitive auction reserve prices to guide market price increases (expected price increases), while pilots in Hubei and Guangdong use lower-than-market auctions to guide quota prices down (expected price declines).

At the same time, pilots such as Hubei and Guangdong allow individuals to participate in trading, which enhances the public’s understanding of climate change, emission reduction, carbon market, carbon trading and other knowledge concepts and links with life.

It is hoped that the national carbon market will launch the auction trading model as soon as possible, and include investment institutions and individuals to better serve the market and increase the attention of the carbon market and the enthusiasm of the masses.

Development of future pilot carbon markets

After the national market was launched, the pilot coverage narrowed and affected transaction volumes. The coverage of the Guangdong pilot program in 2021 includes an empty auction enterprise quota of 252 million tons and a later reserve quota (new project enterprise auction + market adjustment) of 13 million tons, with a total of 265 million tons.

In 2021, the Guangzhou electric power industry began to break away from the pilot and enter the whole country. In comparison, the coverage of the Guangdong pilot in 2020 totaled 465 million tons (including 438 million for emission-controlled enterprises and 27 million for reserve quota), which is nearly twice that of 2021.

Therefore, Guangdong pilots lowered the threshold for industry inclusion, and included industries such as data centers, textiles and ceramics. The Guangdong pilot program has been tightening the free quota for the past four or five years. This year, the cement, steel, petrochemical and paper industries have been reduced by 1% compared with last year. At the same time, the proportion of paid allocation for new projects has been expanded from 3% to 6%.

It is expected that as more industries are incorporated into the national market, and one matures into the other, they will be removed from the pilot and linked to the national carbon market, but if the national market is slower than expected, the pilot may continue to exist after 2025.

The pilot also has an existing role and is irreplaceable. The uniqueness of the pilot lies in the association with local enterprises, the regional characteristics of the industry, and the familiarity and training of local exchanges with enterprises.