Have you heard of green bonds and social bonds?

Since the seven ministries and commissions jointly issued the Departments on Building a Green Financial System in 2016, China’s green finance development has gradually accelerated. At the same time, green finance has been accelerating to become the mainstream of the financial industry internationally, and more capital is leaning towards green finance. Today, let Treelion walk you through some of this.

What is green finance?

Green finance refers to economic activities that support environmental improvement, response to climate change, and resource conservation and efficient use. For instance, projects in the fields of environmental protection, energy conservation, clean energy, green transportation, and green buildings financial services such as investment and financing, project operations, risk management.

According to an industry research report by Barclays Bank in September 2020, about one-third of the world’s GDP output depends on biodiversity, and the world’s annual economic benefits from the ecosystem exceed 125 trillion US dollars. Therefore, with the support of green finance, more funds will be invested in the protection of the ecosystem.

Theoretically, compared with traditional finance, green finance can use ecological assets to create more value while protecting the environment.

The development of green finance

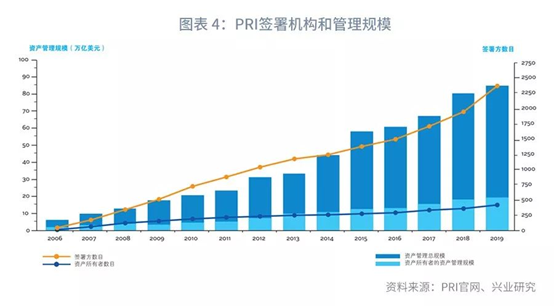

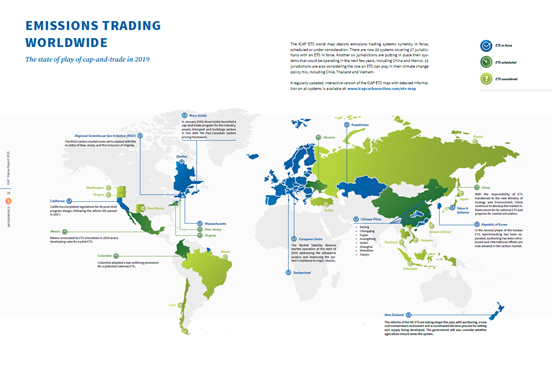

There are more green finance projects nowadays, including the signing of responsible investment principles, carbon trading, green bond issuance, and disclosure of corporate social responsibility and environmental and social governance etc, growing exponentially.

Pain points of green finance development

Although the momentum is strong, there are still some problems in the development of green finance.

- Social capital investment is still insufficient. Due to the objective reasons of the level of economic development, the public regards the green economy as a passive measure to improve the ecological environment, and long-term green economic projects in developing countries have less capital investment.

- The complex standards of the green industry system are not centralized. Taking carbon sink trading as an example, there is currently no centralized standard in the world, and the certification process and standards are very different, thus forming market thresholds, and industry standards still need to be further regulated.

- The types of green financial products are relatively single, mainly relying on green bonds and green credit development. The volume is huge, and it is difficult for ordinary residents and small and medium-sized enterprises to participate. There is no sustainable business model that can guide private capital, SME capital and the entry of personal capital into the green finance market has further led to insufficient social capital investment for the development of green finance.

Opportunities and challenges coexist

It is precisely because of the urgency of environmental protection and the obstacles to the development of green finance that more large international institutions are now focusing on the innovation of green finance, hoping to find new breakthroughs.

For example, the International Finance Forum, known as the G20 financial version, recently held the 2020 Global Green Finance Innovation Award, hoping to have innovative projects to promote the development of green finance.

For another example, hosted by Global Capital and Euromoney, Moody’s, BNP Paribas, Fitch Ratings, JP Morgan Asset Management, Central University of Finance International Institute for Green Finance and other institutions will participate in the China Debt Capital Market Online Summit 2020. Discuss the development direction of green bonds, and will focus on emerging socially responsible bonds.

Treelion has always been concerned about the development of green finance, based on big data, AI, blockchain and other distributed technologies, while reducing costs and risks, it realizes the standardization of green assets and enhances the financial attributes and value of green assets. Green assets that are difficult to trade (such as ecological resources, carbon emissions, etc.) bring liquidity, and at the same time, use the distributed characteristics of blockchain to customize green project-specific electronic vouchers for all interested individuals, institutions, and companies to achieve Safe storage of green assets and value transfer on the public chain; and under smart contracts, realize the on-chain registration of assets, value exchange, distributed data storage, point-to-point transmission, consensus mechanism, and the use of encryption algorithms for certified green assets And its value.

Treelion is focused on the current development opportunities of green finance, aiming to help everyone to participate in green finance, and ultimately build a broad and inclusive green finance ecosystem.